INSURING

HIDDEN RISK

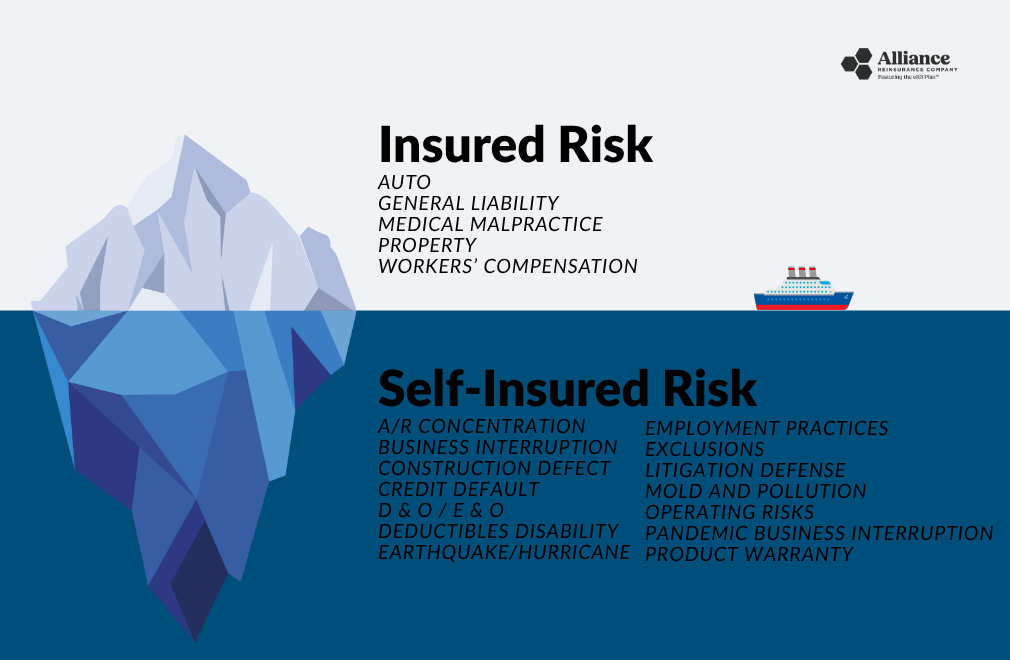

Most business owners unknowingly self insure a large amount of risk. Many of these are hidden or “below the surface” risks inherent in the operation of a business.

Any material risks can be insured.

If insurance claims are as projected, the reinsurance company may retain profits that can be distributed to its owners.

FORWARD

For many years, large corporations have used alternative risk transfer strategies to augment commercial P&C policies, reduce insurance costs, mitigate claims and improve risk management. With the changing dynamics among traditional property and casualty insurance companies, these benefits are even more important to middle market companies, as well as groups and associations.

A Reinsurance Company platform is the premier risk management and risk financing tool. For forward-thinking companies, managing and financing risks (as well as protecting assets) have become important aspects of overall business strategy.

We invite you to review this website and contact us to discuss how your organization can obtain the benefits of a Reinsurance Company and other alternative risk transfer vehicles.